Look to the data: it’s a motto we live by here at Cision, and one we reinforce with our clients every day. That’s because data, validated with expert insight, is your best predictor for success in almost any – if not every – area of your communications strategy.

Events are no exception. Not only are they one of the best ways to build interest and excitement in your organization and any new developments, they also present some of the richest opportunities to connect with journalists face-to-face and build relationships that could lead to better coverage for your brand down the line.

So where does data come in? As one of the world’s biggest medical conferences approaches, now is the opportune time to illustrate how data can inform your event communications strategy. Our Insights experts explored media coverage of last year’s American Society of Clinical Oncology conference (ASCO) to glean insights that communicators can apply to their event communications strategy – both for ASCO 2023 and beyond.

Lesson 1: Strike while the iron is just warming up

At five days in length, ASCO is one of the longer industry conferences out there. The pattern of coverage surrounding the event, however, is like other big industry conferences and events, so the takeaways here apply not only to your strategy for ASCO 2023, but other events, too.

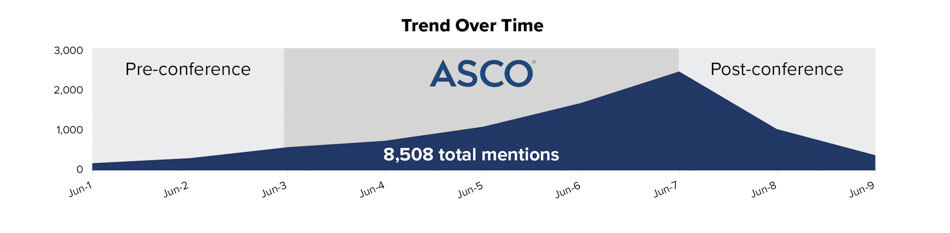

The chart above reflects the coverage volume for the days leading up to, during and after ASCO 2022, a key indicator of the best times to start promoting your message. “Understanding the daily volume of coverage can be really informative for how you position your own press outreach,” says Liz Hogan, Senior Director for Insights Growth, Health and Medical at Cision Insights. “If you know from past data that coverage will peak on the last day of the conference, then you want to avoid scheduling your big announcement or press conference occurring at that time. Your message might get lost in the wave of all of the other coverage.” If you can’t avoid inopportune timing, Hogan suggests employing strategic outreach to mitigate the risk of drowned out coverage.

With ASCO, for example, the data show that coverage builds slowly in days leading up to the event, peaked during the final few days of the conference, and still earned substantial coverage in the days after.

Given this pattern, Hogan advises brand communicators begin outreach and event promotion early on, in the days and weeks leading up to the conference, when coverage is at a lower volume. “If you have the opportunity to create early outreach, you have the ability to stand out, because there's just so much less competition for visibility compared to when your announcement is going out,” Hogan says.

When it comes to post-conference outreach, similar rules apply. “Save some of that media outreach [to reinforce your story] until maybe a week or so after the conference, when that ‘tail’ [of coverage volume] has really started to thin out.”

For example, if your chief medical officer is going to be on a panel on the final day of the conference, consider teasing up that speaking engagement early on in effort to get a boost in exposure in advance of that massive wave of coverage. The effort will serve not only to build expectation and excitement, but also to help ensure your message reaches audiences before the flood of coverage threatens to drown it out.

“The bottom line is this: your best ammunition for a powerful media presence during an industry event is data. Understand what volume looked like in previous years, compare that to when you’ll be making news this year, and employ the right tactics to amplify that message,” Hogan advises.

(Just look at what Taylor Swift did to garner attention for her most recent album release – long before it even hit digital shelves. That same “long build up” strategy can apply to your event strategy, serving not only to build expectation and excitement.)

Lesson #2: The Big Picture Matters

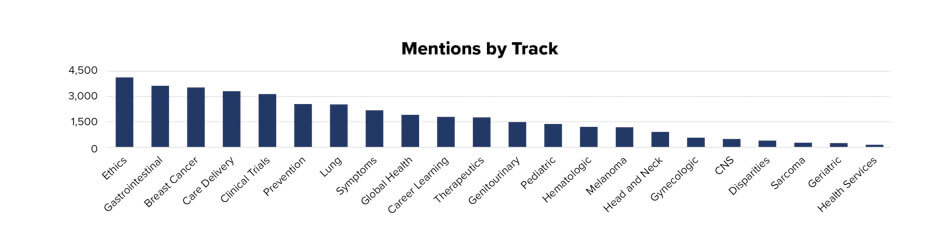

The chart above provides insight into the major themes in ASCO media coverage last year. Understanding what topics resonated with the media the most can help you inform more strategic messaging.

When it comes to ASCO in particular, it’s not uncommon to see two or three subsets of cancer as the “big” stories. But last year’s data shows something surprising: “Two out of the top four coverage areas were ethics and care delivery, not therapeutic areas. These are much bigger, broader concepts – concepts that can have very positive brand reputation impact,” Hogan points out.

The lesson, she says, is to think about how your message fits into bigger, broader topics beyond your immediate therapeutic, which can build a stronger, farther-reaching narrative. For example, if you are trying to get coverage for a medical breakthrough or study, consider how the results of that study could have broader implications for health equity or global well-being.

“If you can help connect those dots to DEI or other ‘bigger picture’ concepts, that is what's going to resonate with the journalists, and we have the data to demonstrate that that's what's going to boost or amplify your message,” Hogan says.

That’s why it’s critical to stay up to date on emerging issues and broader industry trends beyond your brand performance in the media. Whether through your own team’s monitoring efforts, via pre-set, automated insights alerts or through daily news briefings, this year-round work lays a foundation to build on so you understand where your story fits into the larger picture are positioned to create a timely narrative.

Bottom line: Think bigger picture to connect your story to appeal to larger concepts and wider audiences.

Lesson #3: Smaller audiences can yield bigger returns.

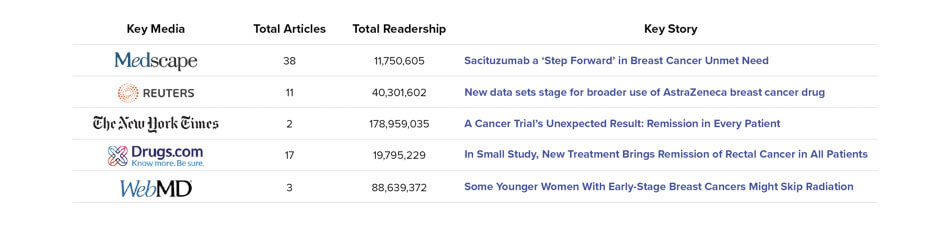

Cision’s analysis also looked at total readership from the top publications covering ASCO, as demonstrated in the snapshot above. While online news aggregators like Yahoo and MSN helped boost volumes of coverage during ASCO 2022, top publishers including Reuters and The New York Times served as a driving force behind original content. Both publications covered a breast cancer study that extended survival by six months. The New York Times also wrote about an 18-patient rectal cancer study, while Reuters’ other big stories included the trial of an oral drug combination fighting childhood brain cancer, studies identifying patients who may skip chemo, and an experimental drug seeking to prevent the spread of lung cancer to the brain.

But though the The New York Times certainly boasts the biggest audience, it is important to keep in mind that it only covered two stories: That equals a lot of competition for coverage.

The lesson: Use data to look beyond the big-ticket publishers with the highest potential reach. Identify the journalists and publications who’ve not only covered ASCO, but also who’s covered your brand or organization’s specific therapeutic area, or whose audiences are going to benefit the most from your findings, or your research. “Everybody's chasing after the New York Times, so break away from the pack, and go after that one journalist who really gets your space. That applies across the board,” Hogan says.

“Even though the readership is enormous, the juice might not be worth the squeeze in terms of the reputational impact or getting the information in front of the right kind of decision makers and thought leaders and big care providers – whoever is really going to move the needle for your brand or business.”

For example, if your event messaging centers around lung cancer, it’s likely a better investment of your time to narrow in on the journalists who talked to the most about lung cancer last year, because they already understand that focus area, and you will have to spend less time educating them about the disease state.

Trade publications should also not be overlooked, Hogan says. While they may not have the same reach as top-tier publishers, trade publications like Medscape provide important coverage of conferences like ASCO. These trades were among the most prolific publications in covering ASCO and they are reaching a target audience: care providers. Instead of just looking at volume to spot high-impact outlets, Hogan suggests looking at validated viewership, such as Cision’s Impact data. “Validated views tells you not just how many people may have seen your coverage, but how many eyes actually fell on the story. That data point often illuminates that some of the smaller trade outlets you may not be chasing after have the highest success rate in amplifying your message.”

Bottom line: Know which media outlets to target for maximum impact – they aren’t always going to be the most obvious choice.

If you want to maximize your presence at any event, one of the smartest moves you can make is to look at trends from the previous year and understand what efforts will resonate the most with audiences.

Want a report on your 2022 performance to inform your strategy going into ASCO 2023? Or a custom report that can help you plan your 2023 event strategy? Speak to an Expert.